Just a short article today to point out the importance of thinking long term when investing. I see many people losing their shit over the last week due to the drop in the markets.

The media isn’t helping. Over the last 10 years there have been many days where the markets have gone up by over 1% with no media story. Just a few days of drops and the media are all over it with article after article trying to incite fear. Where were the articles on all the good days? That doesn’t create clicks. Don’t buy into all the noise.

Maybe it will help if I put it into perspective.

Let’s see how the last week of what may feel like significant falls compares to the last year and the last 20 years.

1 week stock market performance

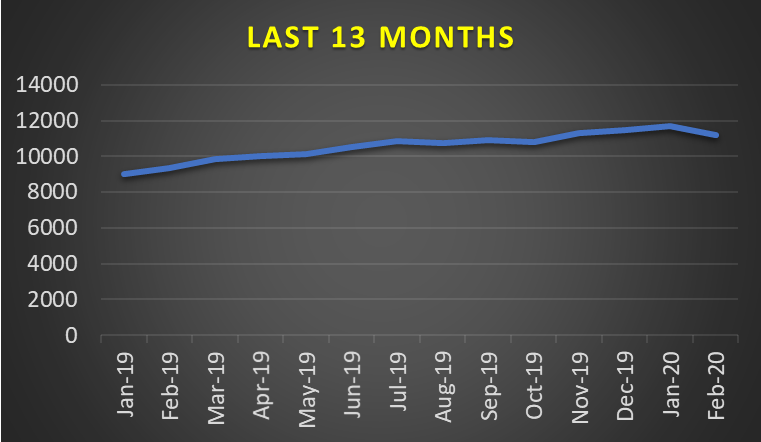

1 year stock market performance

19 year stock market performance

Investing is for the long term - so zoom out

As you can see, we are only back to the same levels seen in November 2019. Only 7% down from the peak on February 21. Yet the markets increased by 25% over the last year and 530% over the last 19 years.

This is only a drop in the bucket.

When we look at the last week it looks terrible, yet when we zoom out to the last 19 years, the last week’s drops are not even recognisable. Even when we zoom out a year it is barely recognisable.

The point is investing in the sharemarkets should be a long term investment, so why look at short term results?

Have an investment plan

If you are thinking of selling now when it wasn’t part of your plan, then you have one of three things wrong:

1/. You are not investing for the long term

2/. You don’t have any goals for your investments

3/. You don’t have an appropriate asset allocation. In other words, you are holding too much in growth assets such as shares. More than your tolerance for risk can handle.

Or any combination of the above.

As an example, I am seeing and hearing of many wannabe first home buyers who are hoping to use Kiwisaver to buy a house shortly, yet they were in growth funds. Now they are surprised their account is dropping rapidly. It shouldn’t be a surprise. Such people are clearly not investing for the long term, so should have no business in growth funds.

People who were overconfident or didn’t have a clear investment plan are learning an expensive lesson.

If one of the three criteria for a sound investment plan are off then you need to sort that out first and foremost. Make some goals, decide on your investment horizon, and think about how you react to losing money. Then you can make an investment portfolio that you are more likely to stick out through thick and thin. A well written plan will make you less likely to deviate.

If you are all sorted in all three criteria, then as long as it is being reviewed once a year, have confidence in your plan. You set it up that way for a reason. And stop looking at your account balance!

I’ve avoided looking at my balance for the last week because I know I won’t like what I see. Even though I know what is waiting me if I looked, it still helps me stick to my guns by pretending it isn’t there.

Selling before you are ready will more often than not lessen your long-term returns. First you need to be able to sell at the right time – who knows if this is just a small blip or not. Secondly, you need to buy back in at the right time. Blink and prices may be more expensive than when you sold them. Too much time sitting on the sidelines may be costly.

You need to get the timing right not once, but twice.

This is why dollar cost averaging works so well. Investing every month will mean you are buying shares whether the markets are up or down at a wide range of prices. It will all average out in the long term and you get to remain in the market, not missing out on the gains.

The only way to lose over the long term is to not be a participant.

If you are still worried, here are some tips to help prepare for a recessionary economic environment.

If you need an investment plan or recommendations , then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here