Up until about 5 years ago, I thought there was only one way to retire. Work for 40 plus years until my mid to late 60’s, until I had enough money to retire with some help for NZ Superannuation.

Since then, I’ve learned a lot about financial independence and how to achieve it. Simple concepts such as compound interest, index fund investing and high savings rates have helped me understand there are other options, one of which is early retirement.

But what if traditional retirement nor early retirement suit you? Are there other ways to approach your retirement and work life?

I believe there are plenty of approaches. Let’s dive into some of them now.

1/. Traditional retirement

What is traditional retirement?

Get a job, work hard for 40 plus years, and retire in your 60’s to enjoy the last couple of decades of your life.

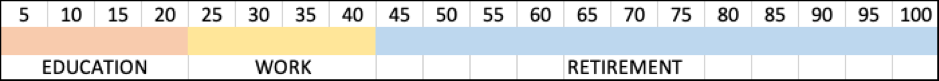

TRADITIONAL RETIREMENT TIMELINE

Pros and cons of traditional retirement

Pros:

You don’t need to save so much money. Approximately 15% of your annual income should get you there.

You don’t need to worry about an inability to access Kiwisaver since you will still be earning income up to retirement age.

You won’t be bored working

Cons:

You won’t have much say in how you spend your time since you are so reliant on a job and income.

You may experience prolonged workplace stress

You may not get to enjoy your retirement due to ill health

2/. Early retirement

What is early retirement?

Very appealing to many people, less work and more retirement. What’s not to like? The problem some people have with early retirement is that it requires quite a long time, saving a high percentage of your income. I would consider any age before 60 as early retirement. Anything after that is more traditional.

Early retirement generally will require you to save anywhere upwards of 20% of your income. Closer to 40% if you want to retire in your 40’s or 50’s.

EARLY RETIREMENT TIMELINE

Pros and cons of early retirement

Pros:

Freedom. This is the big benefit. You no longer need income from work since your savings are large enough to provide for your spending needs. As such, you can spend your time as you please. No one else owns your time.

No work-related stress

Possible tax and benefit advantages. Lower tax rate means better returns on investments, and lower income may mean certain benefits such as child subsidies.

Experiencing retirement while your mind and body are in much better shape

Cons:

Leaving work during your peak earning years. Leaving a lot of money on the table, but hopefully will never be needed.

Possible boredom or lack of challenges if you don’t have much of a life purpose outside of work.

Long period of time before you are able to access Kiwisaver

Your skills may become outdated if you do need to return back to work.

Saving a high percentage of your income may be considered a con for some.

3/. Mini retirement

What is a mini retirement?

Instead of taking a 30-year retirement all at the end of your life, the theory behind mini retirements is that you take more, but smaller retirements, much sooner. In other words, they are spread out over your life.

For example, someone with a young family may want to take 5 years off when they are first born. Another 5 years off from when they are age 13 to 18 to make the most of the time before they leave the house. Then maybe two years off for every five years worked. It doesn’t really matter how many or how often. It could even be just one mini retirement. It depends on what is best for your given situation, but below is an example of what a mini retirement scenario may look like.

MINI RETIREMENT TIMELINE

Yellow is work, and blue is retirement years.

Mini retirements are only made possible, because like the early retiree you are a disciplined saver with a good savings rate. Overall, you will generally work close to the amount of years as a traditional retiree, but it will not be consecutive years.

If you save 50% of your income, then you can take 1 year of work off for every worked. 20% of your income and you can take 1 year off work for every 4 years worked. Just note, that eventually you will have start saving for retirement because you can’t work forever.

Pros and cons of mini retirements

Pros:

Never working for too many years in a row may keep you revitalized and not bored

A good balance between work and life

Ability to design your life so you can achieve short bursts of time freedom much sooner than a traditional retiree

Achieving life goals much earlier

Cons:

Depending on how many and how long your mini retirements are, you may need to work much later in life than an early and traditional retiree. Possibly even in to your 70’s to make up for lost earnings.

When taking extended breaks, it can really put you back in terms of income. Chances are you will go back to a lower paying job, especially if your skills are no longer relevant or out of date.

By spending your savings on your mini retirements, you eliminate the compounding benefits of front loading your savings, since you basically have to keep starting over again.

4/. Semi-retirement

What is semi-retirement?

Despite initially aiming for early retirement, semi-retirement is actually my goal now.

Semi-retirement is referred to by the cool kids nowadays as Coast FI. It still involves work but work that you want to be doing that allows you to pursue your outside of work hobbies and interests. For many, this will mean a reduction in income. It could mean keeping the same job but only working part time hours. Or it may mean taking on less hours at a much less stressful, but lower pay job, in an industry that is much more appealing to you.

Semi-retirement is only made possible by several years of high savings rates. Then, by switching to a part time job that covers your expenses, you will no longer be saving or investing. This isn’t a problem though, as your savings will continue to grow untouched thanks to compounding interest. Eventually, your savings will be at a level where you can decide to stop working altogether if you wish.

I like semi-retirement because it allows me to quit the rat race much earlier than I would have if I were pursuing any of the other forms of retirement. Even if I were pursuing early retirement, I am sure I would still be working in some capacity anyway and with semi-retirement I can pull the plug on full time work much earlier than with the early retirement option. In other words, a work/life balance that will leave me challenged and fulfilled, with enough time freedom to do more of what I love.

SEMI RETIREMENT TIMELINE

Pros and cons of semi-retirement

Pros:

You work for longer than early retirement, but for reduced hours than you would under traditional retirement which allows a healthy work/life balance

Partial time freedom able to be achieved much sooner than in early retirement

Unlike mini retirement, compound interest still gets to work its magic as your savings remain untouched thanks to part time work covering expenses

Cons:

It will take longer to reach full financial independence, but depending how long you have worked and how much you have saved, early retirement can still be achieved. This is not a problem if you want to continue to work in some capacity anyway.

Once you take on reduced hours or a lower paying job in a new industry, it can be difficult to get back into higher paying work if needed.

You are still somewhat answerable to a schedule as you are still reliant on some income.

5/. Temporary retirement

What is temporary retirement?

Similar to the mini retirement philosophy, but temporary retirement instead spends your entire middle years to yourself and family. Doing what you love while your mental and physical abilities are at their height. Enjoying your children while they are still at home. Then, after you’ve lived the best years to yourself or you have run out of money, you can go back to work if you need to.

It generally means 10-15 years of work saving a very high percentage of your income, much similar to the early retirement model. Then time off to pursue your passions. This could be 10 or 15 years, or possibly even longer depending on how much you save and spend. Will typically look like this:

TEMPORARY RETIREMENT TIMELINE

Pros of temporary retirement

Pros:

Allows you to spend your best years pursuing your passions

Don’t have to work too many years in a row

Tax and beneficiary advantages

Cons:

Requires a very high savings rate

Requires drawdown of your savings very early in life

May mean working late in your life which is no guarantee

Will be difficult to return to work after such an extended absence

Final thoughts

For visual ease, below I have grouped each retirement as to what it may look like:

Summary of the timelines of the different paths to retirement

Just like there are many paths to financial independence, there are also many paths to retirement. The great thing is you can pick the option that best suits you depending on your situation. How much do you like your job? How is your health? What is your family situation? What are your goals? Do you have strong passions outside of work? How much money have you saved?

How you answer these questions will help determine which option may be best for you.

Maybe, like me, you have gone through most of life oblivious to all the options. Well the good news is you may not be as “stuck” as you once thought.

Traditional retirement doesn’t work for me anymore, neither does early retirement. Both scenarios will require me to work full time at a high stress job throughout my 40’s at a time when I am most valuable to my family. Between my children aged 5 to 15, I want to be there for them as much as possible. Semi-retirement will allow this. It doesn’t make sense to work full time until my 50’s or 60’s. By then, my kids will have flown the coop and I will have missed out on so much time with them. By then, they won’t want much to do with me and aren’t so reliant on me.

By front loading our savings we can pull the plug on full time work in a few years’ time. I can work on my financial advisory business, and my wife can work part time in her industry if she wants, which as it happens, she does. We will earn enough to cover our expenses for the next 15 years while our savings grow untouched. By then we will be financially independent should we want to stop working. We may want to continue with the semi-retirement, even if we don’t need to financially. This is thanks to being able to work at jobs we want to, not have to. Thanks to not being so reliant on income and optimizing our expenses so we aren’t huge spenders.

That being said, this path may be a terrible idea for you. Your situation is unique, but hopefully you can apply some of my thought process to your situation.

If you need help with your personal retirement planning, then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here