Last week I shared an article that showed how dramatically market volatility reduces when investing over long time frames. Have a refresh of that article as we are using the same data here.

From that same data we can have a look at how many periods of negative returns there were.

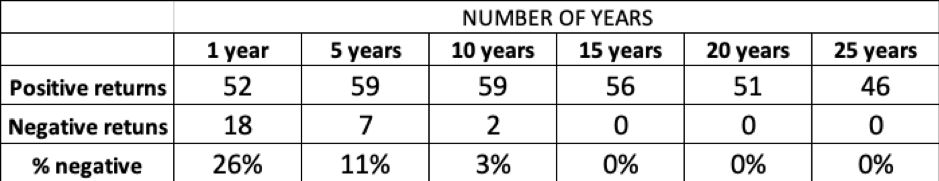

Number of periods with negative investment returns over various timeframes

Just like last weeks reducing volatility, the longer the time horizon the better chance of positive returns.

18 out of 70 1 year periods of the S & P 500 since 1950 have been negative. Just over a quarter. Yet, no period of longer than 15 years has been negative. Progress has historically always been made. 97% of 10 year time horizons have been positive.

So if you want the best chance of not underperforming the market (excluding fees), then long term diversified investing is the name of the game. Not only are returns less volatile (smoother), positive returns are also more likely.

The more you sell out of the market, the greater the likelihood of experiencing sub par returns. So realise that short term losses are perfectly normal before you decide to jump ship.

If you need an investment plan or recommendations , then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here