Over the last few weeks I have discussed two similar but very different retirement income products in New Zealand. Both products produce an income by using equity in your home.

Last week we discussed reverse mortgages, which have been around for many years. And two weeks ago, we discussed a new retirement income product to the NZ market, Lifetime home.

Today, we won’t go into too much detail about what each of these products are and the pros and risks involved. We did that in the previous articles if you want to check those out.

In this article, we are comparing the two and thinking about which instances one product may be preferred over the other, which may be useful for someone who has no other option to produce retirement income than by using equity in their home.

The similarities between a reverse mortgage and a Lifetime home retirement product

They both provide an income for you in retirement (although how much they provide is very different).

They both require you to have a freehold home (or very close to).

They both require you to hold house insurance.

They both require legal representation to go over the contract.

They both require the youngest borrow to be a minimum age. Reverse mortgage is typically 60 years old and Lifetime home is 70 years old.

They both exclude certain types of properties, such as leasehold, small homes, atc.

They both exclude certain locations, such as rural.

They both require an independent valuation at your cost.

They both require you to have a well maintained home.

The differences between a reverse mortgage and a Lifetime home retirement product

A reverse mortgage provides income to you by you (the borrower) taking out a loan. Typically a maximum of 30% of the value of the house, but varies depending on age, location, state of home, and other personal factors. You are charged interest on the loan over time and typically pay back the loan when you sell or pass away. A lifetime home income provides income to you by Lifetime buying into your home equity – 3.5% per year to a maximum of 35% after 10 years. In return for you giving up partial ownership, they pay you an income of 2.5% per year (minus fees) of the value of the home at the beginning of the contract.

With a reverse mortgage, you retain 100% ownership of the home. With Lifetime home, you give up 3.5% equity in your home per year to a maximum of 35%.

With a reverse mortgage, you have a loan to pay back. With Lifetime home, you have no loans to pay. Just loss of equity and fees.

If your house loses value with Lifetime home, they share in your losses. If your house loses value with a reverse mortgage, you are on your own (although reverse mortgage providers do say you won’t be on the hook if the value of the reverse mortgage ever exceeds the value of your home).

With Lifetime home, capital gains in the value of the house are shared with Lifetime home. With reverse mortgages, you keep all capital gains.

You can likely borrow more with a reverse mortgage than the income you will receive with Lifetime home.

You can borrow larger lump sums with a reverse mortgage. Lifetime home income comes in the same amounts each year.

You can get a reverse mortgage 10 years sooner than a Lifetime home income.

Lifetime home income stops after 10 year contract. If you need income after 10 years you will likely have to give up more equity in your home or find income elsewhere.

The lists look pretty similar in size, but the magnitude of the differences are far greater than the magnitude of the similarities.

a COMPARISON BETWEEN A REVERSE MORTGAGE AND lIFETIME hOME

The best way to illustrate is with an example. We will assume Tom has recently retired and exhausted all other savings options. He has decided to utilize some of the equity in his home to provide some income.

Tom has a $1 million home mortgage free. He is wondering if he is better off getting a reverse mortgage or a Lifetime home income.

First, the reverse mortgage. We will assume Tom is 70 years old (the same age as the earliest he is entitled to Lifetime home) and is able to get a reverse mortgage of up to $300,000. Since the Lifetime home is only able to provide $22,700 a year for 10 years, we will assume that is how much Tom withdraws per year from a reverse mortgage.

We will assume the average 10 year reverse mortgage interest rate is 10%.

Finally, we will assume the house increases in value by 3% per year.

At the end of 10 years, the loan, and associated fees, are approximately $405,000. The house is worth $1.34 million. This means the equity in the house is around $935,000 in this example. $65,000 less than the original value 10 years earlier but $227,000 has been borrowed and used as income.

Same assumptions for the Lifetime Home product. The house is worth $1.34 million (same as above) and you have $870,000 in equity. $65,000 worse off than in the reverse mortgage scenario.

How about the following, with changes to the rate of house price increases?

Equity in the house remaining on a $1 million house with an income drawn of $22,700 a year for 10 years using different rates of house price appreciation. Reverse mortgage product vs Lifetime Home product

The reverse mortgage coming out ahead at all levels of house price gains except 1%. Lifetime only performing better up to around 1.3% house price gains or less. The higher the house price gains, the larger the difference between the two products in favour of the reverse mortgage.

These percentages work on any dollar value of house.

We have altered the house price gains variable. Now we will have a look at changing the interest rate variable on the reverse mortgage loan to see what impact that has.

Going back to the original $1 million house value (3% house price appreciation) example, let’s see how the two compare with changes in mortgage rates after 10 years.

Equity in the house remaining on a $1 million house with an income drawn of $22,700 a year for 10 years using different mortgage interest rates. Reverse mortgage product vs Lifetime Home product on a house that gains in value by 3% per year.

Would need a reverse mortgage loan of almost 13% for the Lifetime home product to see you better off than a reverse mortgage.

This is with house price gains of 3% too.

What if we alter the house price gains AS WELL as the mortgage rates?

Let’s start with 1% house price gains per year over 10 years:

Equity in the house remaining on a $1 million house with an income drawn of $22,700 a year for 10 years using different mortgage interest rates. Reverse mortgage product vs Lifetime Home product on a house that gains in value by 1% per year.

3% house price gains:

Equity in the house remaining on a $1 million house with an income drawn of $22,700 a year for 10 years using different mortgage interest rates. Reverse mortgage product vs Lifetime Home product on a house that gains in value by 3% per year.

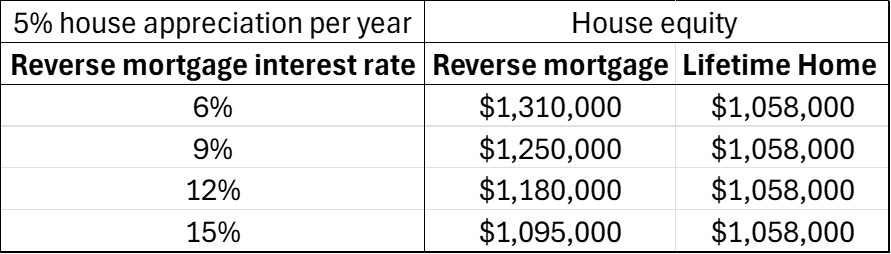

5% house price gains:

Equity in the house remaining on a $1 million house with an income drawn of $22,700 a year for 10 years using different mortgage interest rates. Reverse mortgage product vs Lifetime Home product on a house that gains in value by 5% per year.

7% house price gains:

Equity in the house remaining on a $1 million house with an income drawn of $22,700 a year for 10 years using different mortgage interest rates. Reverse mortgage product vs Lifetime Home product on a house that gains in value by 7% per year.

9% house price gains:

Equity in the house remaining on a $1 million house with an income drawn of $22,700 a year for 10 years using different mortgage interest rates. Reverse mortgage product vs Lifetime Home product on a house that gains in value by 3% per year.

The numbers rounded for easier reading.

At 1% capital gains in house price per year for 10 years, a reverse mortgage providing more equity up until a mortgage rate of around 9.5%. Anything more than 9.5% mortgage at 1% capital gains in house prices and Lifetime product would see you better off.

At 3% house price appreciation per year, it is not until a 10 year average mortgage rate of around 12.8% that Lifetime home performs better. Anything less than that and reverse mortgage is the winner.

At 5%, 7% and 9% house price appreciation, all mortgage rates 15% and below see you better off with a reverse mortgage. The gap getting larger the more house prices increase.

So over 10 year periods, it seems the only times the Lifetime product will leave you with more equity is if:

House price gains are 4% and interest rates are 15% or more;

House price gains are 3% and interest rates are 12.8% or more;

House price gains are 2% and interest rates are 11.3% or more;

House price gains are 1% and interest rates are 9.5% or more.

Using historical averages, the average floating mortgage rate has been around 7% over the last 25 years or so. So that would place a good chance of a reverse mortgage being somewhere around the 9% mark (2 percentage point premium).

At a 9% interest rate, there is no level of house price gains where the Lifetime home product outperforms a reverse mortgage over 10 years.

At a 9% interest rate and a $1 million house, with a reverse mortgage you would have:

$95,000 more in house equity at 3% house price appreciation;

$192,000 more in house equity at 5% house price appreciation;

$310,000 more in house equity at 7% house price appreciation;

·$450,000 more in house equity at 9% house price appreciation.

Over the last 30 years, house price appreciation has been around 6%.

So using the average house price appreciation and average floating mortgage rate you would be around $250,000 better off with a reverse mortgage on a $1 million house over 10 years.

Of course averages can’t be relied on for the future. However, it would have to be a pretty extreme example for the Lifetime Home product to provide a better result.

Your house would either:

Have to lose value over 10 year period;

Gain less than 1% per year with interest rates 9% or more;

Gain 1-2% per year with interest rates 11% or more;

Gain 2-3% per year with interest rates 12% or more;

Gain 3-4% or more with interest rates 15% or more.

These are some extreme examples that are far removed from the averages. But they are examples that are what most people would label a risky position. So in that sense, the Lifetime product could be seen as a hedge (risk minimization) against the worst case scenarios. However, that could be a large cost to pay should the upside occur.

Before we declare victory to reverse mortgages, there is one big omission that we need to consider.

With Lifetime Home, after 10 years you no longer have any payments to make. You are also receiving no income. However, with a reverse mortgage after 10 years, you still have a ballooning mortgage unless you sell the home.

If you want to continue living in your home after the 10 year period (age 80 in this example), then you need to allow for the reverse mortgage loan growing exponentially.

The reason the reverse mortgage loan did so well in these comparisons is because we drip fed the money in year by year and over a period of 10 years to match the same income stream as Lifetime Home. However, reverse mortgages can be much more dangerous when you take out all the money up front (large lump sum) and over long periods of time. More money borrowed for longer is a bad combination as was seen in last weeks blog on reverse mortgages.

We will run one more scenario then where we will extend you living in the home for another 10 years to age 90. We will assume no more income from these products, rather just the original borrowing amounts ($22,700 a year for 10 years). Again using a $1 million property as the example. We will assume a 9% mortgage rate over 20 years and just 3% house price gains.

The reverse mortgage would see you with house equity of around $910,000 and Lifetime Home would see you with around $1.17 million. $260,000 better off with Lifetime Home. You would need house price gains of around 4.8% or more to be better off with this example. With historical increases of 6% over the last 30 years that is not out of the question, however it is more of a line call now.

Final thoughts

Reverse mortgages can be a very dangerous product in my opinion if not used wisely. By that I mean taking out too much money, too soon, and for too long.

Lifetime Home is a product that provides an income for 10 years. So on a like for like basis, reverse mortgages will see you better off in most scenarios.

Just don’t fall into the trap of taking out reverse mortgage too early and holding it for too long. Because you can take out reverse mortgages 10 years sooner than Lifetime Home’s alternative. As discussed, after 10 years, the situation for having a reverse mortgage gets worse too.

Lifetime Home product can be a good option for those who expect to live in their home for 15 years or longer after taking out the initial contract. Also for those who arer worried about interest rates getting too far north of 10% or house price gains of less than 2% per year. By not taking on a loan and having lower gains, you give up less with the Lifetime Home product, so it can offer that downside hedge.

Conversely, don’t be scared about a mortgage either. Lifetime Home’s main selling point is that you won’t have a mortgage. Although that is true, the cost of not having the mortgage is giving up equity in the house. At the end of the day, all you care about is how much money you will have left in your house. And in most instances, on a like for like basis, reverse mortgages will leave you on top.

Both these products are expensive and have many financial implications for you. Any decision around which product to use should not be taken lightly. Preferably with the support of family and trusted legal and financial professionals.

Where possible, try to find some income from other areas such as part time work, downsizing house, sale of an asset, reducing unnecessary expenses, and so on. But in saying that, don’t be afraid of using equity in your house to take on one of these products either. Reverse mortgages do get a bad wrap, but if either of these products help you to continue your best life then why not. You only get one life and can’t take money with you. Some may say you are being selfish but it is your money to do with as you please.

What good is it to leave money to someone you care about if it means compromising your own life? You only get one shot at this life. Live it.

If you need help with your personal retirement planning, then get in touch today.

The information contained on this site is the opinion of the individual author(s) based on their personal opinions, observation, research, and years of experience. The information offered by this website is general education only and is not meant to be taken as individualised financial advice, legal advice, tax advice, or any other kind of advice. You can read more of my disclaimer here